Loan Calculators

Access Tools and Information for Loan Calculations

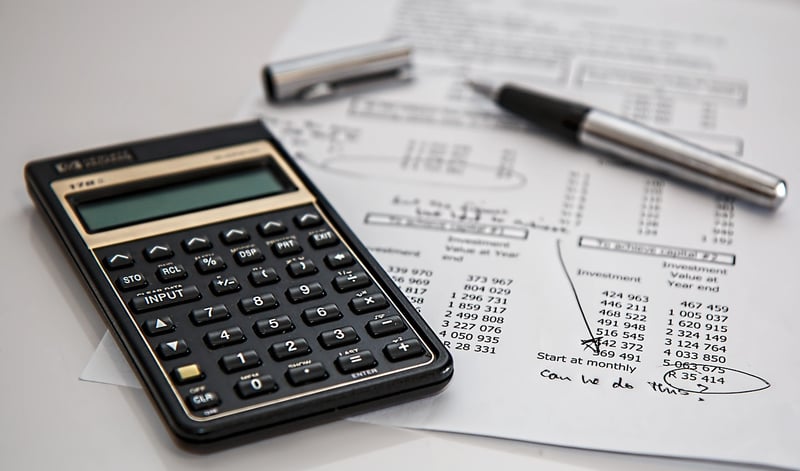

Are you considering taking out a loan but want to understand the financial implications better? Utilizing loan calculators can help you make informed decisions about borrowing money. By inputting relevant details like loan amount, interest rate, and term, you can estimate your monthly payments and total interest over the loan term.

Why Use Loan Calculators?

Loan calculators provide quick insights into the affordability and feasibility of a loan. They can help you:

- Estimate monthly payments

- Compare different loan options

- Understand the impact of interest rates

- Determine the total cost of borrowing

Where to Access Loan Calculators

Several websites and financial institutions offer free loan calculators online. Some popular sources include:

Using Loan Calculators Effectively

When using a loan calculator, ensure you have the necessary information at hand, such as the loan amount, interest rate, and loan term. By adjusting these variables, you can see how changes impact your monthly payments and total interest. Play around with different scenarios to find a loan that fits your budget and financial goals.

Conclusion

Loan calculators are valuable tools that empower borrowers to make informed financial decisions. By utilizing these resources, you can gain clarity on your loan obligations and choose a borrowing option that aligns with your financial situation.